Spotting an unexpected charge on your credit card statement can, you know, really make your heart skip a beat. It’s a feeling many of us have gone through, a moment of confusion and maybe a little worry when a name pops up that just doesn't seem familiar at all. You might be looking at your recent spending, perhaps just doing a quick check, and then there it is: something labeled an "Adswaggy charge." This kind of surprise can truly throw you off, leaving you wondering what in the world it could be and if everything is okay with your money.

A charge like "Adswaggy" on your credit card can feel a bit like finding a mystery package on your doorstep – you’re curious, but also a little cautious. It’s pretty common, actually, for companies to use names on your bill that are different from their main brand, or maybe just a shortened version of their full title. This can make it tricky to figure out where your money went, and that's when a tiny charge can turn into a big question mark in your head. So, it's almost natural to feel a little puzzled by it.

The good news is that sorting out these kinds of charges doesn't have to be a big, scary ordeal. There are, you know, simple ways to get to the bottom of things and figure out what an "Adswaggy charge" really means for you. Think of it like having a friendly helper by your side, someone who can offer quick insights and point you to the right information. This kind of helpful guidance can make all the difference, turning that initial worry into a clear path forward, more or less.

Table of Contents

- What Exactly is an Adswaggy Charge on Credit Card?

- Why Did an Adswaggy Charge on Credit Card Show Up?

- How Can You Spot an Unusual Adswaggy Charge on Credit Card?

- What Steps to Take for an Adswaggy Charge on Credit Card?

- Is an Adswaggy Charge on Credit Card Always a Problem?

- Preventing Future Adswaggy Charge on Credit Card Issues.

- Where Can You Get Help with an Adswaggy Charge on Credit Card?

- Staying Alert to an Adswaggy Charge on Credit Card.

What Exactly is an Adswaggy Charge on Credit Card?

It's a common thing, really, to see a charge on your monthly statement that just doesn't ring a bell. Sometimes, what appears as an "Adswaggy charge" might simply be a billing name that a company uses, which is a bit different from the name you know them by. Businesses often have a special name they use just for processing payments, and this can cause a bit of head-scratching when you're looking at your bank records. You know, it happens more often than you'd think.

For instance, a place where you bought something might have a parent company, or they might use a payment processor with a rather distinct name. So, an "Adswaggy charge" could be from a store you visited, a service you signed up for, or even something you ordered online, just under a different label. It's almost like a nickname for a transaction, which can be a little confusing when you're trying to put the pieces together, in a way.

To figure out what this specific "Adswaggy charge" is, your first move should be to take a closer look at the details of the transaction on your statement. Often, there's a date, an amount, and sometimes even a city or state associated with the charge. These small bits of information can be like clues, helping you remember a purchase you might have forgotten about, or giving you a starting point for some quick digging, so to speak.

Think about it, a helpful program or smart assistant can actually make this process a lot easier. Such a tool can, you know, help you get answers quickly and find information that's relevant to your situation. It's like having a quick way to look up things, which is pretty useful when you're trying to understand a mysterious "Adswaggy charge" that popped up on your credit card bill.

Why Did an Adswaggy Charge on Credit Card Show Up?

There are several pretty usual reasons why an unexpected "Adswaggy charge" might show up on your credit card. One common cause is a forgotten subscription or a free trial that, you know, simply rolled over into a paid service. We sign up for so many things these days, and it's easy to lose track of every single one, especially if the initial period was free or very low cost.

Another possibility is that someone else in your household, perhaps a family member, used your card for a purchase they might have forgotten to mention. This happens a lot with shared accounts or when cards are linked to online shopping profiles. It’s always worth a quick chat with those you live with before jumping to conclusions about an "Adswaggy charge," just to rule out any simple explanations, you know.

Sometimes, the charge could be for something you bought a while ago but was delayed in processing, or it might be a pre-authorization that finally went through. For instance, if you booked a hotel or rented a car, they often put a temporary hold on your card that then becomes a full charge later. This kind of delay can make an "Adswaggy charge" seem out of place when it finally appears, so to speak.

A digital helper, like a smart program, can actually be a big help here. It can, you know, assist you with getting answers, finding inspiration, and being more productive when you're trying to figure out the source of a confusing "Adswaggy charge." You can just ask, and it can help with brainstorming ideas of where the charge might have come from, or even help you put together a list of places you've spent money recently.

How Can You Spot an Unusual Adswaggy Charge on Credit Card?

Keeping an eye on your credit card statements is, you know, a really good habit to get into. It’s like checking your mail every day; you want to see what’s coming in. Regularly looking over your monthly bill can help you spot an unusual "Adswaggy charge" before it becomes a bigger worry. This means not just glancing at the total, but actually looking at each individual line item, more or less.

When you're reviewing your statement, pay attention to the amounts and the dates. Does the amount seem off for something you might have bought? Is the date for a time when you know you didn't make any purchases, or perhaps when you were, you know, out of town? These small details can be pretty telling. An "Adswaggy charge" might stand out if its amount doesn't match any of your recent spending habits, for example.

It's also helpful to compare the charges with your own spending patterns. If you usually only spend money on certain types of things, and an "Adswaggy charge" seems completely out of character, that’s a good sign to investigate further. You know, sometimes our spending habits are pretty predictable, and anything that deviates from that pattern can be a red flag, in a way.

A helpful digital tool can, you know, be quite useful for this kind of review. It can help you organize your thoughts and even prompt you to consider different possibilities when you're trying to make sense of an unfamiliar "Adswaggy charge." It’s like having a brainstorming partner, which can definitely make the task of reviewing your finances feel less like a chore and more like a simple check-in.

What Steps to Take for an Adswaggy Charge on Credit Card?

If you see an "Adswaggy charge" and it’s still a mystery, the first thing to do is just stay calm. Panicking won't help, but taking a few sensible steps will. Start by doing a quick search online for the name "Adswaggy" along with words like "charge" or "billing." Often, other people have had the same question, and you might find forums or websites that explain what the charge is for, you know, pretty quickly.

If your online search gives you a clue about a possible merchant, try to find their website or contact information. Reaching out to the company directly can often clear things up. They can tell you exactly what the "Adswaggy charge" was for and provide details about the purchase. It's often the quickest way to get a direct answer, as a matter of fact.

If you still can't figure out what the "Adswaggy charge" is, or if you suspect it's something not quite right, then it’s time to get in touch with your bank or credit card company. They have teams that deal with these kinds of issues every day and can help you understand the charge or even dispute it if it turns out to be unauthorized. They are, you know, pretty good at this sort of thing.

A smart assistant can, you know, actually help you draft a message to your bank or even find the right contact numbers for customer service. It can also help you gather all the information you have about the "Adswaggy charge" so you're ready to explain everything clearly. It’s like having a personal secretary to help you get your ducks in a row, which can be really helpful when you're feeling a bit stressed.

Is an Adswaggy Charge on Credit Card Always a Problem?

It’s important to remember that not every unknown "Adswaggy charge" on your credit card statement means there’s a big problem. In fact, many times, these charges turn out to be completely legitimate. It might just be a company using a different business name or a slightly confusing description for something you actually bought or signed up for, you know, without realizing it.

Often, what seems like a strange "Adswaggy charge" is simply a merchant's payment processor name, or maybe a shortened version of a well-known service. For example, a streaming service might bill under a corporate name that isn't the one you see in their ads. This is why a little bit of investigation can save you a lot of worry and, you know, prevent you from jumping to conclusions too quickly.

Even if a charge is legitimate, it’s still a really good practice to investigate any unfamiliar "Adswaggy charge." This helps you stay on top of your spending and makes sure you're not paying for things you don't want or need. It's about being a responsible manager of your own money, which is, you know, pretty smart in the long run.

A helpful program can give you peace of mind by finding explanations for these charges. It’s like having a personal researcher who can quickly look up information and provide context, making sure that an "Adswaggy charge" doesn't keep you wondering for too long. This way, you can feel confident that you understand where your money is going, more or less.

Preventing Future Adswaggy Charge on Credit Card Issues.

To avoid future confusion with an "Adswaggy charge" or any other mystery payments, there are some simple steps you can take. One good idea is to keep a running list of all your subscriptions and recurring payments. This could be a simple note on your phone, a spreadsheet, or even just a piece of paper. Knowing what you've signed up for makes it much easier to recognize charges, you know, when they appear.

If your bank offers virtual card numbers, consider using them for online purchases, especially for new services or trials. These are temporary card numbers linked to your main account, and they can often be set with spending limits or expiry dates. This can add an extra layer of protection and make it easier to manage an "Adswaggy charge" if it pops up unexpectedly, as a matter of fact.

Setting up transaction alerts with your bank or credit card company is also a really smart move. You can often get a text message or email every time your card is used, or for any charge over a certain amount. This means you'll know about an "Adswaggy charge" almost as soon as it happens, rather than waiting for your monthly statement, which is, you know, pretty handy.

A smart helper can, you know, actually assist you in managing these records or reminding you about upcoming payments. It can help you keep track of all your financial comings and goings, making it less likely that an "Adswaggy charge" will catch you off guard. It's like having a digital organizer for your money, which can be very reassuring, in a way.

Where Can You Get Help with an Adswaggy Charge on Credit Card?

If you're still scratching your head about an "Adswaggy charge," your credit card company or bank is, you know, your main point of contact. They have detailed records of all transactions and can often provide more information than what appears on your online statement. They can also guide you through the process of disputing a charge if it turns out to be unauthorized, which is pretty important.

Beyond your bank, there are consumer protection agencies that can offer advice and resources if you believe you've been unfairly charged. These organizations are there to help protect your rights as a consumer and can provide guidance on what steps to take next. They are, you know, a good backup plan if you hit a wall with your bank.

Online forums and communities can also be surprisingly helpful. Many people share their experiences with unknown charges, and you might find that someone else has already dealt with an "Adswaggy charge" and can offer insights or solutions. It's like a big group chat where everyone helps each other out, which can be really comforting, so to speak.

A helpful assistant can, you know, offer information on these resources, helping you find the right contact details or guiding you to relevant online communities. It’s like having a research assistant who can quickly pull up the information you need to get help with an "Adswaggy charge," making the whole process feel a bit less overwhelming.

Staying Alert to an Adswaggy Charge on Credit Card.

Being watchful is, you know, a really important part of keeping your finances safe. Regularly checking your credit card statements for anything that looks like an "Adswaggy charge" is a simple but effective way to protect yourself from unexpected surprises. It’s about being proactive rather than reactive, which is always a better approach when it comes to your money, more or less.

Be thoughtful about where you share your card details, especially online. Only use trusted websites and look for secure payment indicators, like a padlock symbol in your browser's address bar. This careful approach can help prevent an "Adswaggy charge" from appearing because of a security issue, which is, you know, a big relief.

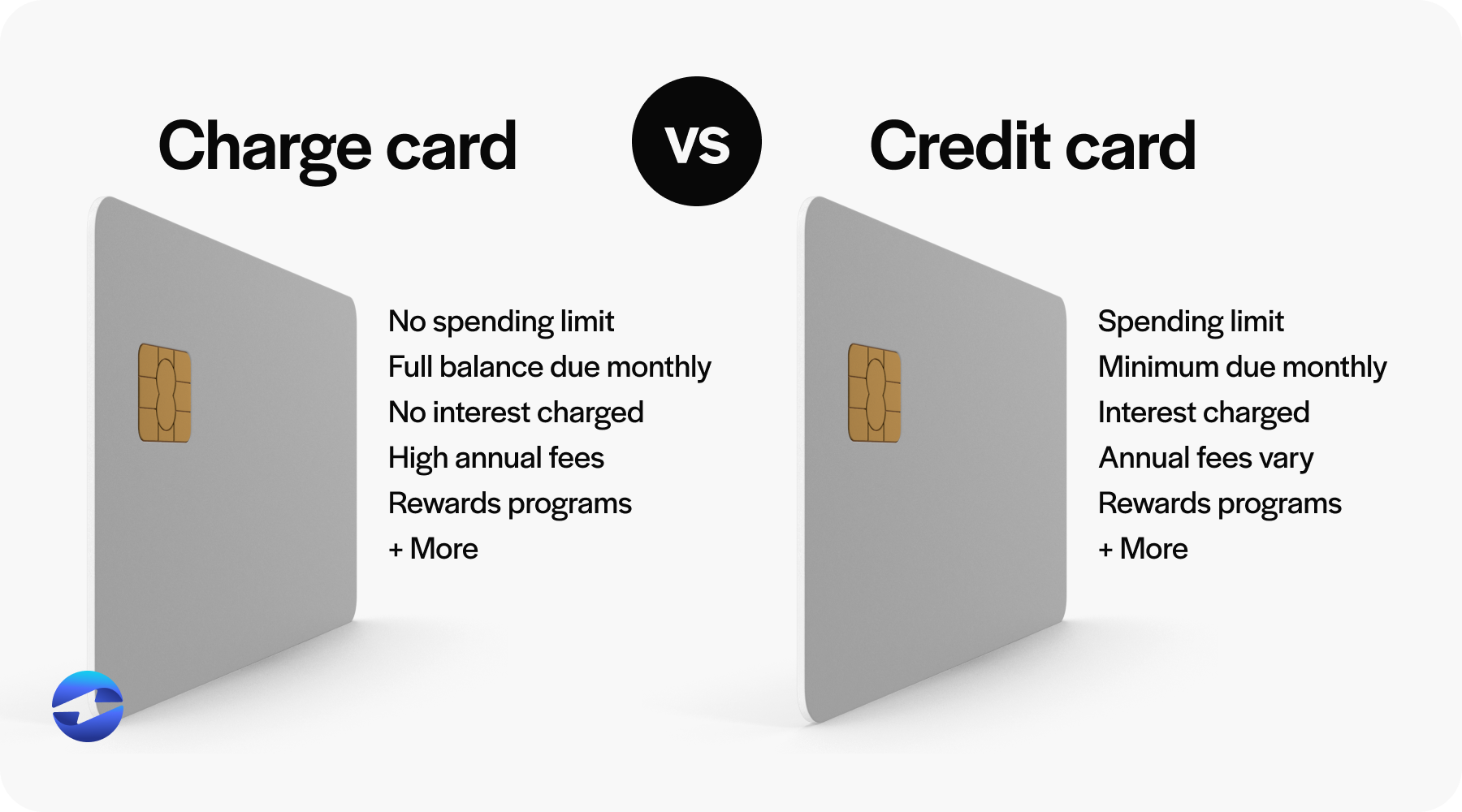

It's also a good idea to understand how different merchants bill their customers. Some might use a parent company's name, while others might have a slightly different name for their online store versus their physical location. Knowing these little quirks can help you quickly identify an "Adswaggy charge" as legitimate, rather than something to worry about, in a way.

A smart helper can, you know, assist you in staying informed about your financial well-being. It can help you keep track of your spending, offer insights into common billing practices, and generally help you feel more in control of your money. It’s like having a friendly guide for your financial journey, which can be very empowering, too it's almost.

This article has covered what an "Adswaggy charge on credit card" might mean, why it could appear, and how to spot it. We also talked about the steps to take if you find such a charge, whether it's always a problem, and ways to prevent future issues. Finally, we looked at where you can get help and the importance of staying alert to your credit card activity.