Imagine, if you will, a collection of items you carry with you every day, some light, some a bit heavy. This is, in a way, what your money obligations can feel like. When we talk about owing funds, it simply means one person or a group has received something, often cash, from another, and there's an expectation for that amount to be returned. It is, you know, a very common part of how people and even big businesses get the things they need, like a house or a new building for work. These financial commitments can show up in a few different forms, some with things used as a promise for repayment, and some without.

The idea of owing money, to be honest, means one side, the one who borrowed, has to give back the funds they got or held onto from the other side, the one who lent it. This can even be something a whole country might owe, which is, you know, a pretty big deal. The folks at the Consumer Financial Protection Bureau, for instance, they actually say that owing money is just what someone owes to another person or a business. So, it's really about that connection where money changes hands, and there's a promise to settle up later.

There are, in fact, different sorts of these money obligations, some of them are considered more helpful than others. Knowing the various kinds, like what you might owe on a plastic card or for your house, and how to deal with them, is a good step. Every time someone gets money from another, an obligation is formed, and it's pretty much everywhere we look, from little plastic cards to vehicle payments to what we owe on our homes. But there's, you know, more to it than just the simple act of owing cash.

Table of Contents

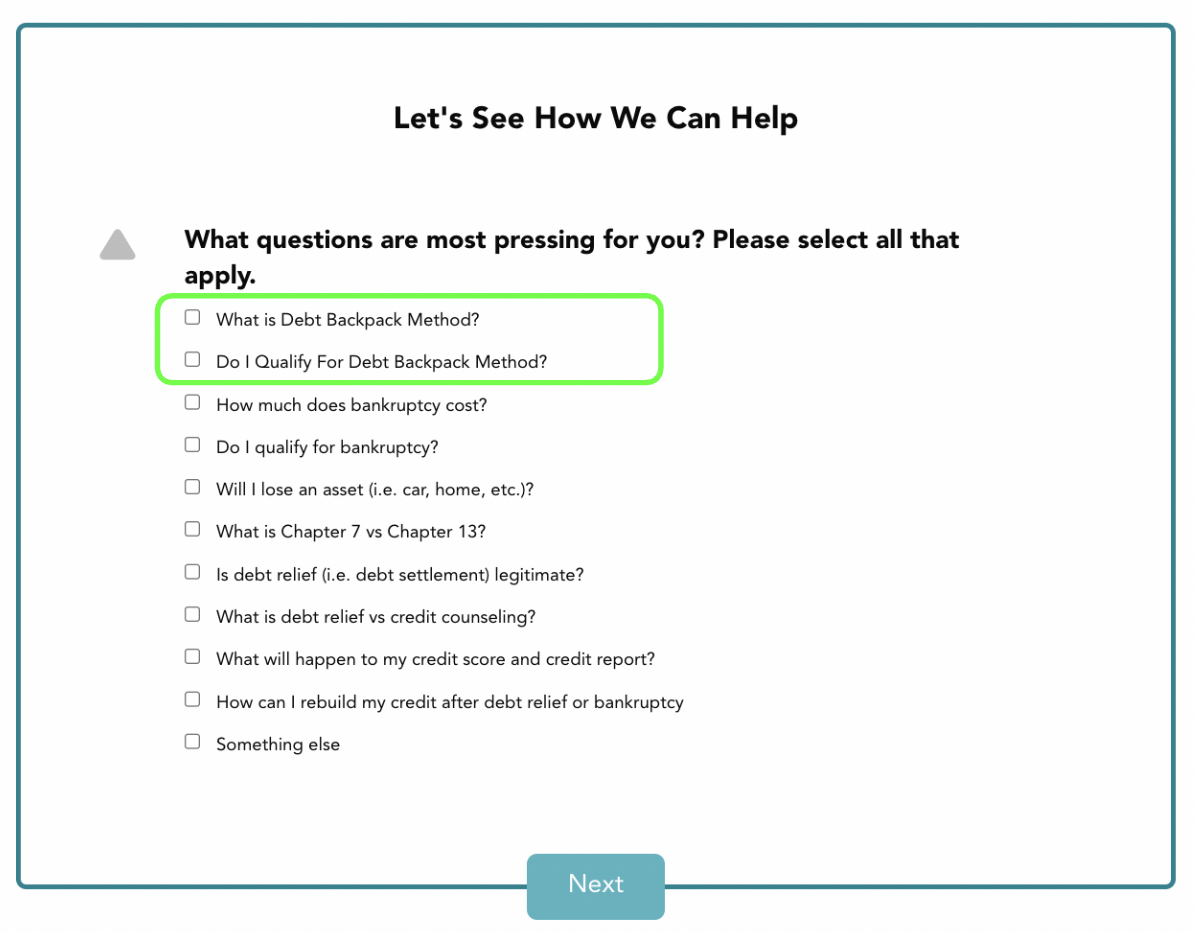

- What Is This Debt Backpack Method?

- Understanding Your Financial Baggage

- How Do You Pack Your Debt Backpack?

- What Goes Into Your Debt Backpack?

- Lightening the Load with the Debt Backpack Method

- Is Your Debt Backpack Getting Too Heavy?

- Keeping Your Debt Backpack Tidy

- Benefits of the Debt Backpack Method

What Is This Debt Backpack Method?

Have you ever thought about your money obligations as things you carry around? The "debt backpack method" is, you know, a way to picture all the different amounts you owe as items you've put into a bag. Just like a real backpack, some things might be small and easy to carry, while others could be quite bulky and weigh you down. This approach helps you see all your financial commitments in one place, making them feel a little less scattered and a bit more manageable. It’s, actually, about getting organized and understanding exactly what you're carrying.

Basically, the idea is to sort through everything you owe, figuring out what each one is, how much it is, and who you owe it to. This method isn't just about listing things; it's about giving each item a place, so you can clearly see the whole picture. When you know what’s in your "debt backpack," you can then make a plan for how to deal with each piece, perhaps taking some out, or maybe even consolidating a few smaller ones into a bigger, but simpler, item. It’s, in a way, about bringing order to what can feel like a very chaotic situation.

This way of looking at your money owed helps you feel more in charge. Instead of feeling like you're constantly reacting to bills as they arrive, you're proactively deciding how to handle each one. It's, as a matter of fact, a way to visualize your financial situation, making it less abstract and more concrete. This can really help you stay motivated as you work through your financial obligations, seeing your "debt backpack" get lighter over time.

Understanding Your Financial Baggage

Before you can even think about packing your "debt backpack," it helps to understand what owing money